From automated salary calculation to quick tax filing, the best HR and payroll systems do it all for you. Adaptive Pay’s solution even integrates with other modules like Leave and Attendance.

Enjoy integrated workflows for cloud-based HR and payroll.

Get automatic calculations based on employee records from other modules like Claims, and prorate salaries & allowances with ease.

Use a constantly updated, IRAS-listed vendor payroll system software in Singapore.

Stay aligned with changing policies, taxation formats, rates, and more.

Make AIS submissions directly to IRAS as we are an IRAS-listed payroll vendor

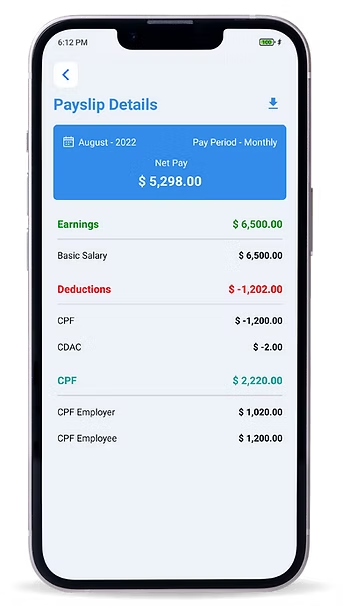

Customise payroll processes as needed and configure employee-specific payroll components such as basic salary, allowances, deductions etc.

Set up multiple payroll schedules so you can run multiple payrolls based on your business requirements.

Link to Singapore’s banks and create records with ease.

Generate multiple bank files for multiple payouts from different bank accounts so you can manage online bank transfers for payroll faster than ever.

Make the app fit your preferred workflow and setup with third-party integrations for apps like Xero, Quickbooks, and more.

Get rid of manual income tax form filing with our HRMS system that generates IR8A, IR21, IR8S and appendix A for you.

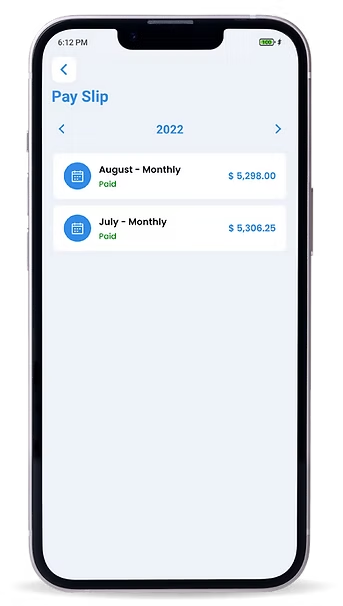

Send employees notifications for payslips via the app.

View and download payslips from mobile app, email, and web, with payslips itemised as per MOM guidelines.

Submit your OED to MOM seamlessly without any hassle from our system

Welcome to the best payroll software in Singapore! Our cloud-based payroll software is designed to simplify your payroll management and improve the accuracy of your payroll calculations. As the top provider of payroll software Singapore, we are committed to delivering the best payroll solutions for businesses of all sizes.

Our payroll software for small business Singapore is specifically designed to meet the needs of small businesses also. With our payroll software, you can easily manage your payroll processes, generate...

payslips Singapore, and comply with tax regulations effortlessly. Our cloud payroll software Singapore offers a comprehensive suite of features to help you manage your payroll efficiently.

As the best software for payroll, our payroll software Singapore is user-friendly and easy to use. Our cloud-based platform allows you to access your payroll information from anywhere, making it convenient for you to manage your payroll on the go. With our cloud payroll software, you can automate your payroll processes and reduce the risk of errors and inaccuracies.

Our payroll software is the best payroll software in Singapore for a reason. With our cloud payroll software, you can improve the accuracy of your payroll calculations, streamline your payroll processes, and reduce the time and resources needed to manage your payroll.

In conclusion, our payroll software is the best solution for businesses in Singapore looking to simplify their payroll management processes. With our cloud payroll software, you can automate your payroll processes, generate payslips Singapore, and comply with tax regulations effortlessly. Try our payroll/HRMS software in Singapore today and experience the benefits for yourself!

Getting started is easy. Simply reach out to our team via the contact form on our website, and one of our representatives will get in touch with you. We’ll schedule a consultation to understand your business needs and guide you through the onboarding process. You’ll be up and running with our HR Payroll Management System in no time.

Feel free to adapt and expand upon these FAQs as needed to provide more information to your website visitors.

Adaptive Pay auto-calculates basic salary, allowances, overtime, deductions, and statutory contributions (CPF, SDL, Funds) based on your payroll rules.

Yes. CPF contributions are auto-computed for employer and employee shares, with differentiated rates for age groups, permanent residents, and wage ceilings.

A smarter way to manage payroll, attendance, claim and appraisals – all in one seamless platform.

Copyright © 2025 – Adaptive Cloud Systems Pte Ltd